Washington and Annapolis Offers a “Carrot,” Other states choose the “Stick” to Encourage Employers to Offer Retirement Savings Programs

May 9, 2023

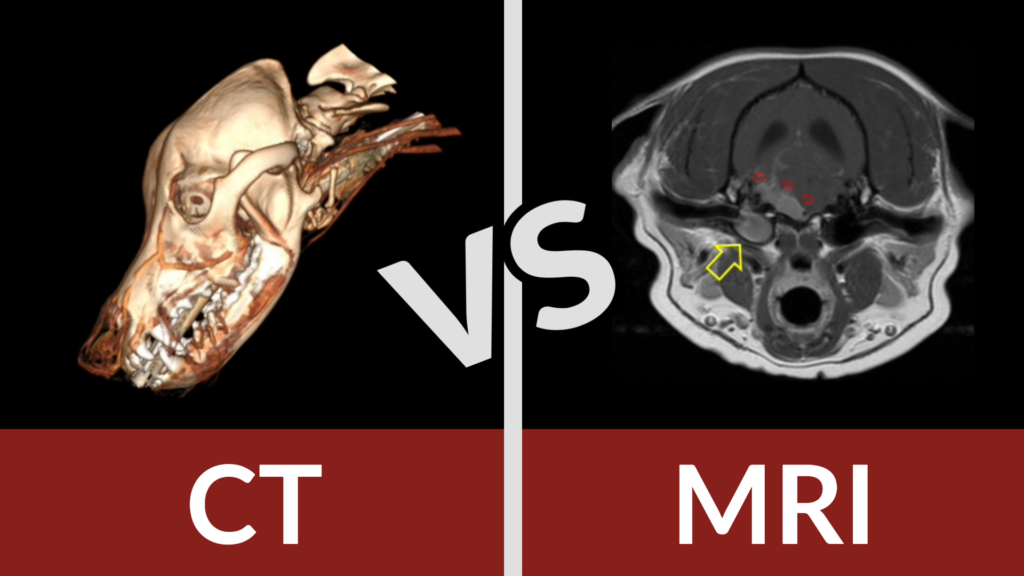

When a patient with suspected neurological disease presents to Veterinary Neurology & Imaging of the Chesapeake, there are a number of steps in the process of identifying, diagnosing and treating their condition...

The post CT vs. MRI: Understanding Neurodiagnostics for Your Pet appeared first on MDVMA.

Company Booth # Antech Diagnostics 12 Banfield Pet Hospital 8 Blue Buffalo Company 24 Boehringer Ingelheim Animal Health 16 Christian Veterinary Mission 13 Compass Veterinary Neurology & Imaging 3 Dulaney Valley Pet Loss Center & Memorial Gardens 4 Everhart Veterinary Medicine 10 First National Bank 22 MWI Animal Health 1 Nexus Veterinary Specialists 17 Nutramax …

Summer Conference Exhibitors Read More »

The post Summer Conference Exhibitors appeared first on MDVMA.

Get the inside scoop on the 2023 legislative session in Maryland and stay up to date with important bills affecting veterinary services and animal welfare. Discover which bills passed, including SB390/HB325 which underwent crucial amendments to ensure the well-being of animals. Find out why HB1227, the bill involving veterinarians as dispensers, did not pass and what efforts are being made to address this issue in the future. Stay informed and be ready to contribute to the conversation in the next legislative session.

The post 2023 Legislative Update appeared first on MDVMA.

MDVMA needs you, our valued members, more than ever. Please take the time to share your concern and/or opposition for House Bill 325 and Senate Bill 390. What is the synopsis? HB 325 and SB 390 will require the State Board of Veterinary Medical Examiners to authorize a veterinary practitioner licensed, certified, or otherwise authorized to practice veterinary …

Concern for HB 325 / SB 390 – Provision of Veterinary Services – Routine Medical Care and Rabies Vaccines Read More »

The post Concern for HB 325 / SB 390 – Provision of Veterinary Services – Routine Medical Care and Rabies Vaccines appeared first on MDVMA.

Dr. Matthew Weeman, DVM, MSBoard of Directors Food Animal RepresentativeChair, Legislative Committee This past session your MDVMA and AVMA both used membership dollars to work hard on your behalf testifying on multiple, critical legislative items. For the first time in Maryland’s history a bill to reward non-economic damages was introduced. This bill was more …

Legislative Update and Request for Your Assistance Read More »

The post Legislative Update and Request for Your Assistance appeared first on MDVMA.

Certified Safety Training offers MDVMA members fully customized and discounted Veterinary OSHA Safety Programs including unlimited online training modules, Certified Safety Data Sheets and dedicated compliance consulting. Veterinary OSHA Compliance Programs give veterinarians and practice managers a comprehensive review of the requirements of select health and safety standards. Each program comes with a written compliance plan, …

MDVMA Partners with Certified Safety Training to Provide Custom Veterinary OSHA Safety Services Read More »

The post MDVMA Partners with Certified Safety Training to Provide Custom Veterinary OSHA Safety Services appeared first on MDVMA.

By Jessica DeCesare, Chief People Officer, VetEvolve People rarely (if ever) go into the veterinary industry without having a true passion for it. You may even remember the specific moment when you decided to have a career in veterinary medicine. Maybe it was when you got your first puppy, your first time riding a horse …

Putting Employees’ Happiness at the Forefront Read More »

The post Putting Employees’ Happiness at the Forefront appeared first on MDVMA.

The American Association of Feline Practitioners and EveryCat Health Foundation Announce Feline Infectious Peritonitis (FIP) Diagnosis Guidelines BRIDGEWATER, NJ; WYCKOFF, NJ; September 1, 2022 – The American Association of Feline Practitioners (AAFP) and EveryCat Health Foundation have released the 2022 AAFP/EveryCat Feline Infectious Peritonitis Diagnosis Guidelines. These landmark Guidelines are published in the Journal of …

2022 FIP Diagnosis Guidelines Read More »

The post 2022 FIP Diagnosis Guidelines appeared first on MDVMA.

The post Meet the DVM Legislative Candidates Running for Office in Maryland appeared first on MDVMA.

The American Veterinary Medical Association and the vast majority of your clients sincerely appreciate your dedication and the quality of care you provide for your patients. That’s why it’s so incredibly difficult when your wellbeing and ability to deliver those services are negatively impacted by bullying, cyber and otherwise. Such has been the case at …

Responding to Bullying Read More »

The post Responding to Bullying appeared first on MDVMA.